Top 5 Items to do When Any Tenant Leaves Your Rental

Dustin Edwards • June 19, 2020

When Your Tenant Leaves More Work is on the Horizon

A tenant leaving is often one of the moments that a property owner dreads. The questions start piling up such as:

- What do I need to do to the property?

- How long will it take me to find a new renter?

- What do I need to do first?

- What do I do about that security deposit?

Instead of looking at a tenant leaving as a laundry list of tasks, we invite you to consider that this is a great opportunity to re-evaluate and get the most from your asset. To help alleviate your fears and tackle the essential items consider key items below.

Tip #1 - Property Inspection

When your tenant leaves, even if they were the best, low maintenance tenant ever it is still important to do a property inspection upon their departure. You could use a professional home inspection company, or if you have many years of rental ownership you could do this yourself. If you are going to do this aspect yourself we strongly encourage you to be critical of your property which can be challenging. This means taking the time to check every socket, get under the sink, in the crawl space (while the water is on), in the attic and run your major systems to ensure everything is in tip-top shape. Taking time upfront to identify what could be wrong with your property can save you late calls when a new tenant arrives.

Tip#2 - Return Their Security Deposit

Remember years ago when they made that security deposit? Especially tenants who have been with you for a while you might have nearly forgotten about their deposit, but it is very important that you evaluate the property to see what can be deducted. For example items such as broken cabinets, doors, or windows that shouldn’t be broken under normal conditions can be deducted from the deposit. Items that are standard “wear and tear” such as paint and carpet can’t be deducted (exception includes deducting for a professional cleaning IF you had it professionally cleaned prior to them moving in). Timing is important as if you don’t return the allocated deposit amount (with supporting documentation if not in full) of 21 days of their move out they are entitled to a full refund.

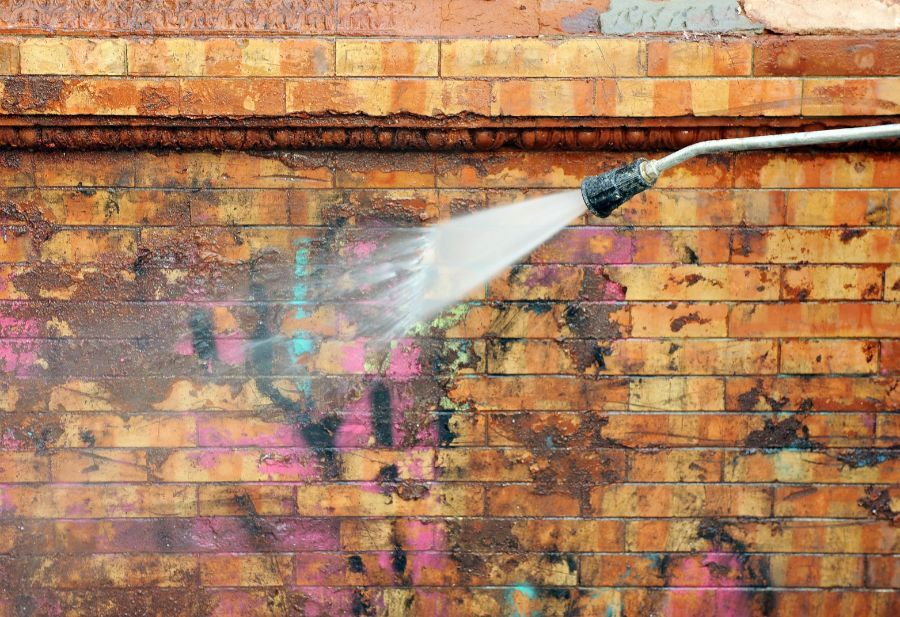

Tip #3 - Make it Move In Ready

Many property owners dread the aspect of getting a new tenant in place as, after all, it is a new relationship you have to build upon. Don’t let the fear of getting a new tenant in place distract you from the job of making your rental move-in ready. There are many items you can do to prepare your property for a new tenant

but overall the key is to make it feel “like new” so it is irresistible for someone to rent. Envision the best possible tenant walking in through the doors and smelling the fresh paint, seeing the sparking carpet and being amazed that they have the opportunity to rent your home and it will help you fix and update the necessary items for your next tenant.

Tip #4 - Take Fresh Photos

Few items are as frustrating for prospective tenants as seeing a Long Beach rental listing, visiting the property and being disappointed that it looks nothing like the pictures! Sadly we have seen many property listings use outdated photos where even the paint colors don’t match up to what is within the property. After you have spent the time to refresh and refurbish your property take the time to take new professional photos to show off the great aspects of your rental. Even if you have added small touches, such as enhancing the curb appeal, take photos that give people a great understanding of what it is like to call your rental property their home.

Tip #5 - Re-Evaluate the Rental Amount

When we meet with new clients one of the most common aspects we find is that their prior rental amount was substantially below market rate. We understand the hesitation in raising rent because the fear is you raise it and you lose a great tenant. Of course if you don’t raise it then you also aren’t maximizing the return on your investment. The key is to strike a balance between return and maintaining a strong tenant. Before listing your property for rent take time to perform a rental analysis

to understand what your property could yield. This can have a big impact on your bottom line as if your rental was off by 7% (some would say not too bad) on a $2,500 a month rental; that means you were short $175 a month or $2,100 annually!

When a tenant moves out it is a new opportunity to evaluate your property, improve the condition, and even increase the yield on your investment. To find out more how we can tackle all of the 5 tips above for you and much more we invite you to call us today (562) 888-0247 and we can help. If you want to have a quick check to see how much your property could fetch in rent we invite you to fill out our Free Rental Analysis

where we perform a comprehensive comparison to share your rental stacks up to the competition.