How to Increase Your Monthly Rental Amount and Your Property Value

Explore Two Options to Improve Your Asset and Increase Your Income

As an owner of a rental property in Long Beach, besides providing great housing for your tenants, a core objective should be to maximize the value of the asset. We covered rental property upgrades in previous updates. Today we wanted to share two key strategies that could allow you to increase your property value AND increase your rental income.

Consider the following strategies to increase your asset value today:

- Adding Square footage to your property

- Changing the configuration with your addition

Increasing Your Property Value with Each Square Foot

As a general rule when you add square footage you are adding value. Adding square footage for a large value increase runs contrary to most renovation shows where they show a transformation of a kitchen and fresh paint and suddenly the property is worth $100,000 more than the purchase price. As a note in those shows the property is usually purchased at a substantial discount from the market price as a result of the condition of the property.

Locally in Long Beach and Lakewood an average property could sell at $458 per sq ft. While that number can vary, even within Long Beach neighborhoods (or by cities, considering in West LA or the Southbay it can be upwards of $1,000 per sq ft) it is a good value to know when determining how you can add value to your property. To add square footage to a property a rough rule of thumb to use is $300 per sq ft for construction costs. This means that should you consider a renovation that adds 300 square ft you could be increasing your property value by $137,400! Even when taking construction costs into consideration this means effectively you have a net increase in value of $47,400.

A Change in Configuration Can Increase Your Rental Amount

Homes in Long Beach and Lakewood come in a variety of configurations. Consider the common property orientations:

- 2 bedrooms, 1 bathroom

- 3 bedrooms, 1 bathrooms

- 3 bedrooms, 2 bathrooms

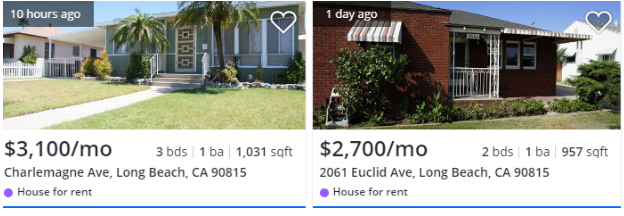

In general the 3 bedroom, 2 bathroom property is the most desirable as it allows for the easiest use for a larger array of prospective tenants (i.e. roommates, families, etc.). As an owner of a rental property in Long Beach, you might be thinking what is the difference in rent between these configurations? While configuration of bedrooms and bathrooms are not the only contributing factors to the monthly rental income, let’s explore a few rental listings in Long Beach that were on Zillow in the 90815 zip code.

When evaluating a 3 bedroom 1 bathroom property vs. a 2 bedroom 1 bathroom property that are close in square footage the difference is $400 a month or nearly 15%. Each year that means that the additional bedroom can add nearly $5,000 a month in annual rental income. With the orientation of many properties in Long Beach the addition of a bedroom can be a manageable addition to your rental.

What if you had an additional bathroom for your Long Beach Rental?

Looking at the same zip code in Long Beach (90815) there is a 3 bedroom, 2 bathroom home available for rent for $3,250. Over a 2 bedroom, 1 bathroom home this would provide for $6,600 more in annual gross rental income and in this case $1,800 in additional annual gross income over a 3 bedroom, 1 bathroom rental home in Long Beach.

We understand that undertaking the addition of a bedroom, bathroom or even a bedroom and a bathroom isn’t easy. We also understand that when you take this approach you will be without rental income during construction, but that is often the cost of investment to have a stronger long term gain. When you want to understand if expanding your rental property is best we invite you to fill out our Free Rental Analysis or call us today (562) 888-0247 and we will be happy to share more information (we can even perform a preliminary property analysis to help you see how your value would increase).